[ad_1]

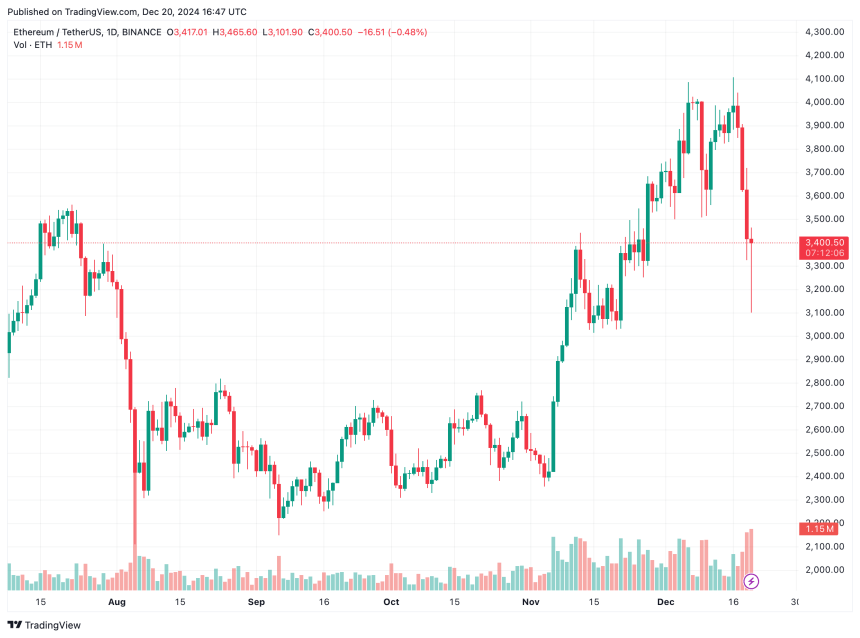

Due to yesterday’s crypto market rout, Ethereum (ETH) has now faced rejection at the key $4,000 resistance level for three times since March 2024. The second-largest cryptocurrency by reported market cap is now trading at the $3,400 level, down 6.7% in the past 24 hours.

What’s Behind Ethereum’s Underwhelming Price Performance?

While ETH has posted a respectable 47% year-to-date (YTD) gain, it has been outpaced by other major cryptocurrencies like Bitcoin (BTC), Solana (SOL), and XRP, which have recorded significantly higher returns in the same period. Several factors appear to be holding back Ethereum’s price momentum.

Related Reading

One contributing factor is Ethereum’s comparatively weaker brand recognition versus Bitcoin. This was highlighted by the lackluster response to the launch of spot ETH exchange-traded funds (ETFs) in August. The introduction of these ETFs failed to generate any meaningful price movement for ETH.

Data further reveals a significant disparity in investor interest between the two assets. The total net assets held in U.S. spot ETH ETFs currently amount to $11.98 billion. In contrast, spot BTC ETFs hold $109.66 billion – nearly ten times as much.

Additionally, yesterday saw over $60 million in outflows from spot ETH ETFs, marking the largest single-day outflow since November 19. Crypto analyst Ali Martinez pointed out that social sentiment around ETH has reached its lowest point in a year. However, based on historical trends, this could paradoxically signal a bullish opportunity for Ethereum.

Futures traders have also turned bearish on ETH, as the aggregated premium for futures positions flipped negative for the first time since November 6. The market downturn triggered Ethereum’s largest liquidation event since December 9, with $299 million liquidated in a single day. Such large-scale liquidations often lead to cascading sell-offs and heightened price volatility.

Another recurring concern stems from the Ethereum Foundation’s tendency to sell ETH near local price peaks. In a recent X post, Lookonchain noted that the Ethereum Foundation sold 100 ETH on December 17. Following this sale, ETH’s price has dropped approximately 17%.

Further skepticism surrounds Ethereum’s supply issuance. A recent Binance Research report highlighted that ETH’s relatively high issuance rate raises questions about its “ultrasound money” narrative, which suggests Ethereum is a deflationary asset.

Is Ethereum Set For A Bounce?

Seasoned crypto analyst @Trader_XO stated that they bought spot ETH at the $3,200 price level yesterday. The analyst added that they expect “a good few weeks” of price consolidation before ETH’s next leg up.

Related Reading

Meanwhile, crypto trader @CryptoShadowOff identified a potential ascending triangle formation on ETH’s monthly chart. According to their analysis, ETH could drop further to the $2,800 range before targeting a new all-time high (ATH).

Market analyst @CryptoBullet1 emphasized that on the 4-hour chart, ETH has not been this oversold since August 5, indicating a bounce may be on the horizon. At press time, ETH trades at $3,400, down 6% in the past 24 hours.

Featured image from Unsplash, charts from Coinglass, X, and Tradingview.com

[ad_2]

Source link