[ad_1]

- Spot Bitcoin ETFs boosted the industry’s mainstream credibility.

- The market appears to be pessimistic about Solana ETFs at this time.

- Short-term price movements cannot be used to gauge ETF approval.

The approval of U.S. spot Bitcoin ETFs in January 2024 marked a watershed moment for the crypto industry. Bitcoin surged to a new all-time high within two months of the ETFs going live, with unprecedented net inflows demonstrating pent-up demand and solidifying BTC’s status as a legitimate investment asset.

The success of Bitcoin ETFs paved the way for altcoin ETF applications, with Ethereum products next in line for potential approval. Riding this wave of optimism, investment managers have begun filing for Solana ETFs, with VanEck taking the lead. However, unlike the enthusiasm surrounding Bitcoin and Ethereum ETFs, the market’s response to Solana ETF prospects has been notably subdued.

Market Skepticism Surrounds Solana ETFs

VanEck’s Solana ETF filing on June 27 sparked a 10% surge in SOL’s dollar value, closing at $149.30 on the day. However, this momentum has waned amid broader market uncertainties, as SOL has struggled to hold onto its gains in the days following the announcement.

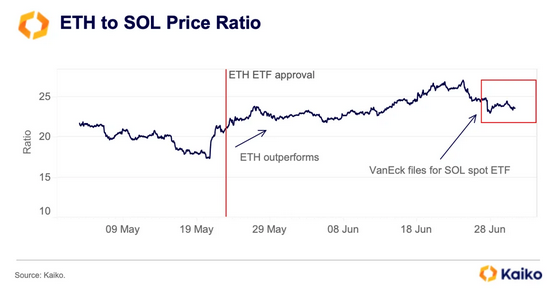

Data from Kaiko revealed that the ETH to SOL ratio has remained relatively flat since VanEck’s filing, further highlighting the market’s muted reaction. While Solana had outperformed Ethereum in March, as evidenced by a sharp decline in the ratio, this trend reversed following the approval of Ethereum ETF applications.

Noelle Acheson, a researcher at Macro Now, interpreted this stagnant ratio as a sign of market skepticism regarding the SEC’s willingness to approve Solana ETF applications. In her analysis, Acheson noted that “the market does not seem to be placing much faith in the approval of a SOL spot ETF.”

Despite this, Acheson maintained a cautiously optimistic outlook, suggesting that Solana ETFs could potentially materialize in 2025, contingent on a Republican victory in the upcoming U.S. elections in November.

Matthew Sigel, VanEck’s head of digital assets research, confirmed that the SEC has until March 2025 to decide on Solana ETF approval. The muted market response to spot Solana ETFs so far contrasts with the enthusiasm that surrounded Bitcoin ETFs.

Bitcoin ETFs Paved the Way

The approval of spot Bitcoin ETFs in January 2024 marked a watershed moment for the cryptocurrency industry, following years of SEC rejections. BlackRock’s application in June 2023 was a turning point, leveraging the company’s formidable reputation and high ETF approval rate to inject newfound optimism into the market.

After seven months of intense speculation, the SEC suddenly approved all BTC ETF applications, with the investment vehicles going live shortly after on January 10.

This breakthrough paved the way for altcoin ETFs, with Ethereum emerging as the next likely candidate. While Ethereum ETFs are yet to receive official approval, the market received a significant boost in May 2024 when applicants amended their filings to align with SEC preferences.

The key change involved removing Ethereum staking from the ETF fund operations, demonstrating the industry’s willingness to adapt to regulatory concerns. This move was widely interpreted as a positive step towards eventual approval, further fueling market optimism.

Nate Geraci, co-founder of the ETF Institute, expects the SEC to greenlight Ethereum ETF in mid-July.

On the Flipside

- Price movements of BTC, ETH, and SOL, whether in dollar terms or relative to each other, should not be used as indicators of ETF approval, as multiple other factors can influence their prices.

- Speculation is mounting on which altcoin is next for an ETF product.

Why This Matters

Approved or denied, Solana ETF applications underscore the evolving relationship between traditional finance and crypto assets, highlighting the delicate balance regulators must strike between fostering innovation and ensuring investor protection.

Solana DEX volume flips Ethereum:

Solana Flipped Ethereum Again, This Time in Record Frequency

Polkadot’s massive treasury spend draws criticism:

Why Polkadot’s Marketing Millions Missed the Mark

[ad_2]

Source link