[ad_1]

Michael Saylor’s Microstrategy has just announced a new Bitcoin purchase that has taken the firm’s total holdings to 439,000 BTC.

Microstrategy Has Bought Another 15,350 BTC

A large buyer that has had a constant presence during this latest Bitcoin bull run has been Microstrategy. The cryptocurrency’s price has been racing up while the company has been accumulating and it seems even at the current highs the firm doesn’t feel done, as it has announced a new purchase.

During this latest buying spree, the company acquired a total of 15,350 BTC for approximately $1.5 billion at an average price of $100,386 per token between the 9th and 15th of December.

In a new post on X, CryptoQuant community analyst Maartunn has shared a chart that visualizes the points at which Microstrategy has made purchases during the last couple of months.

The six purchases that the firm has made during this bull run | Source: @JA_Maartun on X

Out of these six buys, the latest purchase is the smallest in BTC value, but not so in USD value, as it slightly outweighs the 15,400 coins buy from earlier in the month thanks to the asset’s price continuing to see appreciation since then.

The total Bitcoin holdings of Microstrategy have now risen to 439,000 BTC, as the below chart shows.

The growth in the Microstrategy BTC holdings over the years | Source: @JA_Maartun on X

From the chart, it’s visible that the firm’s buying during this bull run so far has been more aggressive than during the 2021 rally, making this latest accumulation spree the largest that it has participated in.

In total, the company has spent $27.1 billion to buy its BTC over the years, at an average price of $61,725. Thus, it seems Michael Saylor’s bet has been working out, with his firm sitting on profits of more than 72% at the current price.

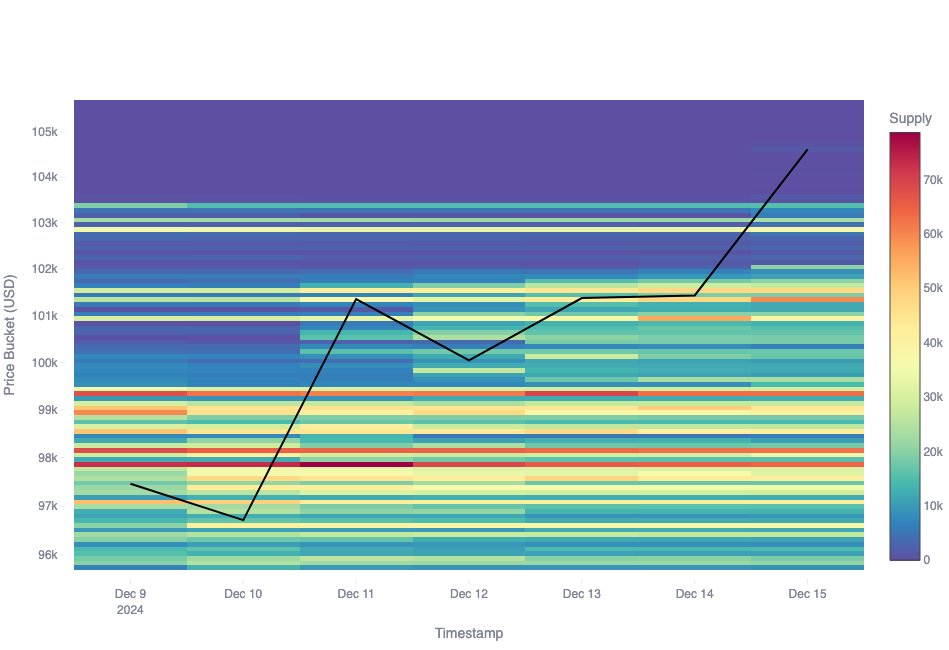

In some other news, as Bitcoin has set a new all-time high (ATH) beyond the $106,000 level, the on-chain analytics firm Glassnode has shared how accumulation leading up to this milestone has looked from the perspective of its its new Cost Basis Distribution (CBD) tool.

The distribution of the BTC supply across the various cost basis levels | Source: Glassnode on X

The CBD is an indicator that tells us how much of the cryptocurrency’s supply was last purchased (based on the last transaction price or Realized Price of each token in circulation) at the different price levels.

As is visible in the chart, Bitcoin investors participated in a notable amount of buying and selling between $96,000 and $100,000, with the $97,000 to $98,000 cluster particularly standing out for hosting the cost basis of 500,000 BTC.

Above the $100,000 level, trading activity has continued, but so far, the investors haven’t built up any significant supply clusters yet, with levels above $103,000 being especially thin with coins.

BTC Price

At the time of writing, Bitcoin is floating around $106,400, up more than 8% over the last seven days.

Looks like the price of the coin has shot up over the past day | Source: BTCUSDT on TradingView

Featured image from Dall-E, Glassnode.com, CryptoQuant.com, chart from TradingView.com

[ad_2]

Source link