[ad_1]

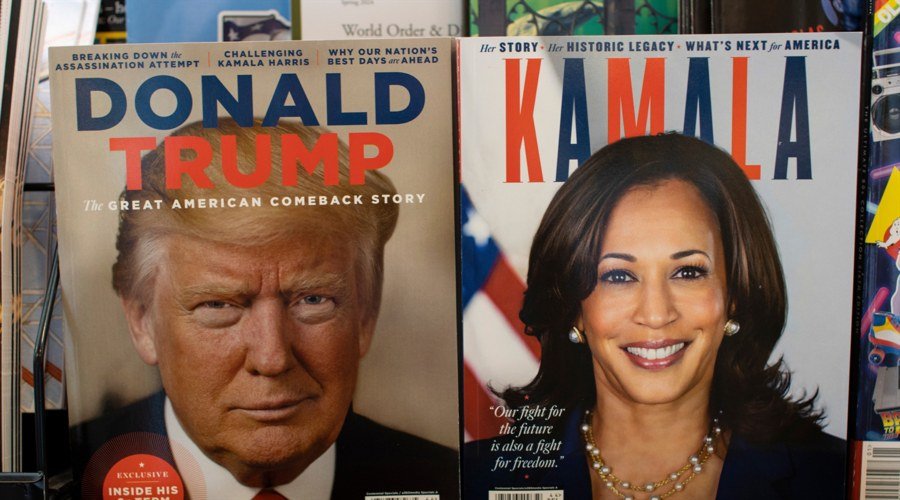

As the United States gears up for another

significant presidential election, the intersection of politics and

cryptocurrency has emerged as a critical area of focus. The candidates, former President

Donald Trump and Vice President Kamala Harris, offer contrasting visions for

the future of digital currencies and blockchain technology. This divergence is

not only shaping the political landscape but also influencing financial

markets, particularly the rapidly growing cryptocurrency sector.

The Crypto Landscape Amidst Political

Uncertainty

Cryptocurrency, once a niche interest, has

evolved into a major financial force. Its decentralised nature and potential

for high returns have attracted a wide range of investors, from tech-savvy

millennials to institutional giants. However, the regulatory environment

remains uncertain, with policymakers grappling with how to integrate these

digital assets into the existing financial system.

In this context, the upcoming U.S.

presidential election could be a turning point. The candidates’ differing

approaches to cryptocurrency regulation and adoption could have profound

implications for the industry. As such, the election is not just a political

contest but a referendum on the future of digital finance.

Wall Street’s Bet on Trump

Wall Street’s apparent preference for a

Trump victory is rooted in his administration’s historical approach to

regulation and taxation. Trump’s presidency was marked by a deregulatory

agenda, which many investors believe could benefit the cryptocurrency industry.

Lower taxes and fewer regulations could create a more favourable environment

for crypto businesses, potentially spurring innovation and growth.

This sentiment is reflected in the behaviour

of prediction markets, where Trump’s odds of winning have surged. Platforms

like Polymarket and PredictIt have seen significant bets placed on a Trump

victory, with some investors wagering millions of dollars. These markets, which

allow users to bet on the outcome of events using cryptocurrency, have become a

barometer of investor sentiment.

One week until the election.

🟥 Trump • 66% chance

🟦 Harris • 34% chanceGet accurate, real-time election odds on the world’s largest prediction market #Polymarket

— Polymarket (@Polymarket) October 29, 2024

The enthusiasm for Trump among crypto

investors is not surprising. During his previous term, Trump expressed scepticism

about cryptocurrencies but refrained from implementing harsh regulations. His

administration’s focus on economic growth and deregulation aligns with the

interests of many in the crypto community, who view excessive regulation as a

barrier to innovation.

Harris and the Promise of Innovation

In contrast, Vice President Kamala Harris

represents a more cautious approach to cryptocurrency. While she has not been

as vocal about her stance on digital currencies, her campaign has emphasised

the importance of innovation and technology. Harris has promised to encourage

the development of emerging technologies, including artificial intelligence and

digital assets, while ensuring consumer protection and financial stability.

Harris’s approach reflects a broader

Democratic strategy of balancing innovation with regulation. Her administration

would likely prioritise consumer protection and financial stability,

potentially leading to stricter regulations on cryptocurrencies. This could

include measures to prevent fraud, protect investors, and ensure the stability

of the financial system.

Despite these potential challenges,

Harris’s focus on innovation could also benefit the crypto industry. By

fostering a supportive environment for technological development, her

administration could encourage the growth of blockchain technology and digital

assets. This could lead to new opportunities for entrepreneurs and investors,

even if it means navigating a more complex regulatory landscape.

The Role of Prediction Markets

The divergence between traditional polls

and prediction markets highlights the unique dynamics of this election. While

many polls show a close race between Trump and Harris, prediction markets have

consistently favoured Trump. This discrepancy can be attributed to several

factors, including the influence of large investors, or “whales,” who

have placed substantial bets on a Trump victory.

These markets, which operate on blockchain

technology, offer a decentralized platform for betting on the outcome of

events. They have gained popularity in recent years, particularly among crypto

enthusiasts who appreciate their transparency and accessibility. However, their

predictions should be interpreted with caution, as they reflect the views of a

specific subset of investors rather than the broader electorate.

The influence of prediction markets on

media coverage is also noteworthy. As these platforms have gained prominence,

their odds have been cited as evidence of Trump’s growing lead. This has

contributed to a narrative that may not fully align with traditional polling

data, underscoring the complex relationship between media, markets, and public

perception.

Latest Swing State Odds

🟥 Arizona • Trump 74% – Harris 26%

🟥 Georgia • Trump 73% – Harris 27%

🟥 Wisconsin • Trump 59% – Harris 41%

🟥 Michigan • Trump 53% – Harris 47%

🟥 Nevada • Trump 66% – Harris 34%

🟥 Pennsylvania • Trump 62% – Harris 38% pic.twitter.com/8CdT68AfRx— Polymarket (@Polymarket) October 29, 2024

The Future of Cryptocurrency Regulation

The outcome of the election will have

significant implications for the future of cryptocurrency regulation in the United

States. A Trump victory could lead to a continuation of the deregulatory

approach that characterised his previous administration. This could create a

more favourable environment for crypto businesses, potentially attracting

investment and fostering innovation.

On the other hand, a Harris administration

would likely prioritise consumer protection and financial stability,

potentially leading to stricter regulations. While this could pose challenges

for the industry, it could also provide a more stable and secure environment

for investors, ultimately benefiting the market’s long-term growth.

Regardless of the outcome, the election

will serve as a critical juncture for the cryptocurrency industry. As digital

currencies continue to gain traction, policymakers will need to strike a

balance between fostering innovation and ensuring the stability and security of

the financial system. This will require collaboration between regulators,

industry leaders, and other stakeholders to develop a regulatory framework that

supports the growth of digital finance while protecting consumers and

maintaining financial stability.

Fire Gary Gensler

Provide fair regulations that promote innovation and equality through decentralization

Provide disclosures

Give the same freedom to retail as accredited investors get pic.twitter.com/eHbWcBzmq1

— Wendy O (@CryptoWendyO) October 24, 2024

Conclusion: A Pivotal Moment for Crypto

The U.S. presidential election is a pivotal

moment for the cryptocurrency industry. The candidates’ differing approaches to

regulation and innovation will shape the future of digital finance, influencing

everything from market dynamics to investor sentiment. As such, the election is

not just a political contest but a referendum on the future of cryptocurrency.

For investors and industry leaders, the

stakes are high. A Trump victory could lead to a continuation of the

deregulatory approach that has benefited the industry, while a Harris

administration could introduce new challenges and opportunities. Regardless of

the outcome, the election will serve as a critical juncture for the

cryptocurrency industry, shaping its trajectory for years to come.

As the election approaches, the crypto community

will be watching closely, eager to see how the outcome will impact the future

of digital finance. Whether through deregulation or innovation, the next

administration will play a crucial role in shaping the future of

cryptocurrency, influencing everything from market dynamics to investor

sentiment. In this context, the election is not just a political contest but a

referendum on the future of digital finance.

As the United States gears up for another

significant presidential election, the intersection of politics and

cryptocurrency has emerged as a critical area of focus. The candidates, former President

Donald Trump and Vice President Kamala Harris, offer contrasting visions for

the future of digital currencies and blockchain technology. This divergence is

not only shaping the political landscape but also influencing financial

markets, particularly the rapidly growing cryptocurrency sector.

The Crypto Landscape Amidst Political

Uncertainty

Cryptocurrency, once a niche interest, has

evolved into a major financial force. Its decentralised nature and potential

for high returns have attracted a wide range of investors, from tech-savvy

millennials to institutional giants. However, the regulatory environment

remains uncertain, with policymakers grappling with how to integrate these

digital assets into the existing financial system.

In this context, the upcoming U.S.

presidential election could be a turning point. The candidates’ differing

approaches to cryptocurrency regulation and adoption could have profound

implications for the industry. As such, the election is not just a political

contest but a referendum on the future of digital finance.

Wall Street’s Bet on Trump

Wall Street’s apparent preference for a

Trump victory is rooted in his administration’s historical approach to

regulation and taxation. Trump’s presidency was marked by a deregulatory

agenda, which many investors believe could benefit the cryptocurrency industry.

Lower taxes and fewer regulations could create a more favourable environment

for crypto businesses, potentially spurring innovation and growth.

This sentiment is reflected in the behaviour

of prediction markets, where Trump’s odds of winning have surged. Platforms

like Polymarket and PredictIt have seen significant bets placed on a Trump

victory, with some investors wagering millions of dollars. These markets, which

allow users to bet on the outcome of events using cryptocurrency, have become a

barometer of investor sentiment.

One week until the election.

🟥 Trump • 66% chance

🟦 Harris • 34% chanceGet accurate, real-time election odds on the world’s largest prediction market #Polymarket

— Polymarket (@Polymarket) October 29, 2024

The enthusiasm for Trump among crypto

investors is not surprising. During his previous term, Trump expressed scepticism

about cryptocurrencies but refrained from implementing harsh regulations. His

administration’s focus on economic growth and deregulation aligns with the

interests of many in the crypto community, who view excessive regulation as a

barrier to innovation.

Harris and the Promise of Innovation

In contrast, Vice President Kamala Harris

represents a more cautious approach to cryptocurrency. While she has not been

as vocal about her stance on digital currencies, her campaign has emphasised

the importance of innovation and technology. Harris has promised to encourage

the development of emerging technologies, including artificial intelligence and

digital assets, while ensuring consumer protection and financial stability.

Harris’s approach reflects a broader

Democratic strategy of balancing innovation with regulation. Her administration

would likely prioritise consumer protection and financial stability,

potentially leading to stricter regulations on cryptocurrencies. This could

include measures to prevent fraud, protect investors, and ensure the stability

of the financial system.

Despite these potential challenges,

Harris’s focus on innovation could also benefit the crypto industry. By

fostering a supportive environment for technological development, her

administration could encourage the growth of blockchain technology and digital

assets. This could lead to new opportunities for entrepreneurs and investors,

even if it means navigating a more complex regulatory landscape.

The Role of Prediction Markets

The divergence between traditional polls

and prediction markets highlights the unique dynamics of this election. While

many polls show a close race between Trump and Harris, prediction markets have

consistently favoured Trump. This discrepancy can be attributed to several

factors, including the influence of large investors, or “whales,” who

have placed substantial bets on a Trump victory.

These markets, which operate on blockchain

technology, offer a decentralized platform for betting on the outcome of

events. They have gained popularity in recent years, particularly among crypto

enthusiasts who appreciate their transparency and accessibility. However, their

predictions should be interpreted with caution, as they reflect the views of a

specific subset of investors rather than the broader electorate.

The influence of prediction markets on

media coverage is also noteworthy. As these platforms have gained prominence,

their odds have been cited as evidence of Trump’s growing lead. This has

contributed to a narrative that may not fully align with traditional polling

data, underscoring the complex relationship between media, markets, and public

perception.

Latest Swing State Odds

🟥 Arizona • Trump 74% – Harris 26%

🟥 Georgia • Trump 73% – Harris 27%

🟥 Wisconsin • Trump 59% – Harris 41%

🟥 Michigan • Trump 53% – Harris 47%

🟥 Nevada • Trump 66% – Harris 34%

🟥 Pennsylvania • Trump 62% – Harris 38% pic.twitter.com/8CdT68AfRx— Polymarket (@Polymarket) October 29, 2024

The Future of Cryptocurrency Regulation

The outcome of the election will have

significant implications for the future of cryptocurrency regulation in the United

States. A Trump victory could lead to a continuation of the deregulatory

approach that characterised his previous administration. This could create a

more favourable environment for crypto businesses, potentially attracting

investment and fostering innovation.

On the other hand, a Harris administration

would likely prioritise consumer protection and financial stability,

potentially leading to stricter regulations. While this could pose challenges

for the industry, it could also provide a more stable and secure environment

for investors, ultimately benefiting the market’s long-term growth.

Regardless of the outcome, the election

will serve as a critical juncture for the cryptocurrency industry. As digital

currencies continue to gain traction, policymakers will need to strike a

balance between fostering innovation and ensuring the stability and security of

the financial system. This will require collaboration between regulators,

industry leaders, and other stakeholders to develop a regulatory framework that

supports the growth of digital finance while protecting consumers and

maintaining financial stability.

Fire Gary Gensler

Provide fair regulations that promote innovation and equality through decentralization

Provide disclosures

Give the same freedom to retail as accredited investors get pic.twitter.com/eHbWcBzmq1

— Wendy O (@CryptoWendyO) October 24, 2024

Conclusion: A Pivotal Moment for Crypto

The U.S. presidential election is a pivotal

moment for the cryptocurrency industry. The candidates’ differing approaches to

regulation and innovation will shape the future of digital finance, influencing

everything from market dynamics to investor sentiment. As such, the election is

not just a political contest but a referendum on the future of cryptocurrency.

For investors and industry leaders, the

stakes are high. A Trump victory could lead to a continuation of the

deregulatory approach that has benefited the industry, while a Harris

administration could introduce new challenges and opportunities. Regardless of

the outcome, the election will serve as a critical juncture for the

cryptocurrency industry, shaping its trajectory for years to come.

As the election approaches, the crypto community

will be watching closely, eager to see how the outcome will impact the future

of digital finance. Whether through deregulation or innovation, the next

administration will play a crucial role in shaping the future of

cryptocurrency, influencing everything from market dynamics to investor

sentiment. In this context, the election is not just a political contest but a

referendum on the future of digital finance.

[ad_2]

Source link