[ad_1]

Key Takeaways:

- The interest rate cut by the Fed failed to bring the expected positivity in the crypto market, which instead triggered a massive sell-off, with Bitcoin sinking below $99,000.

- The fears of the Fed slowing its rate cuts in 2025 and increasing inflation have weakened investor sentiment.

- The market has adopted a “wait-and-see” attitude, with investors waiting for further monetary and economic policies that are going to be in place.

The cryptocurrency market just experienced a wild day in the wake of the Federal Reserve’s announcement for a rate cut. Instead of rejoicing, investors have seen a strong sell-off, driving Bitcoin and many other altcoins into steep declines. What does this say for the future of the crypto market, and what is going on?

Shock from the Rate Cut Decision

On December 18, 2024, the Federal Reserve officially announced a cut in the benchmark rate by 0.25% to keep it within the range of 4.25%-4.50%. This, in general, would sound positive, since a cut in the interest rate would normally boost so-called ‘risky assets,’ including cryptocurrencies. The market, however, reacted quite contrarily, starting to move completely in the opposite direction.

Why is the Crypto Market “Bleeding”?

- Doused Expectations: The crux of the issue lies in signals about 2025. Powell suggested the Fed has tempered expectations and now sees two interest rate cuts next year instead of four. That hawkish reassessment has led investors to worry the monetary policy will be less “accommodative” than their expectations.

- Accelerating Inflation: The Fed also increased its projection for PCE inflation at the end of 2025 to 2.5% from 2.1%, hinting that inflationary pressures persist, and a soft rate cut by the Fed would be hard to implement soon.

- Panic Selling: These factors combined helped dampen market sentiment. Investors are worried about slower economic growth prospects and a potential decline in capital flow into cryptocurrencies. The result has been a complete sell-off.

More News: How Does This Latest US Inflation News (CPI at 2.7%) Reflect at The Crypto market?

Crypto Market “Shaken”

Bitcoin Plummets

Immediately after the Fed’s move, Bitcoin fell nearly 5.4%, to $100,314. The cryptocurrency had surged to $108,000 following this week’s CPI data, which showed inflation cooled more than expected. The euphoria was short-lived.

Bitcoin fell

Altcoins Take a Hit

It was not the only casualty. Leading altcoins also suffered. Ethereum declined by more than 6%, while XRP, Solana, and Dogecoin dropped around 10%, 7%, and 9%, respectively. The entire crypto market cap was wiped off upwards of $200 million in less than one day.

Mass Liquidations

This price drop led to the liquidation of nearly $700 million worth of derivatives contracts in the past 24 hours. Bitcoin and Ethereum each saw over $100 million in long positions liquidated.

- Bitcoin: -5.4%

- Ethereum: -6%

- XRP: -10%

- Solana: -7%

- Dogecoin: -9%

Stock Market Also “Wobbles”

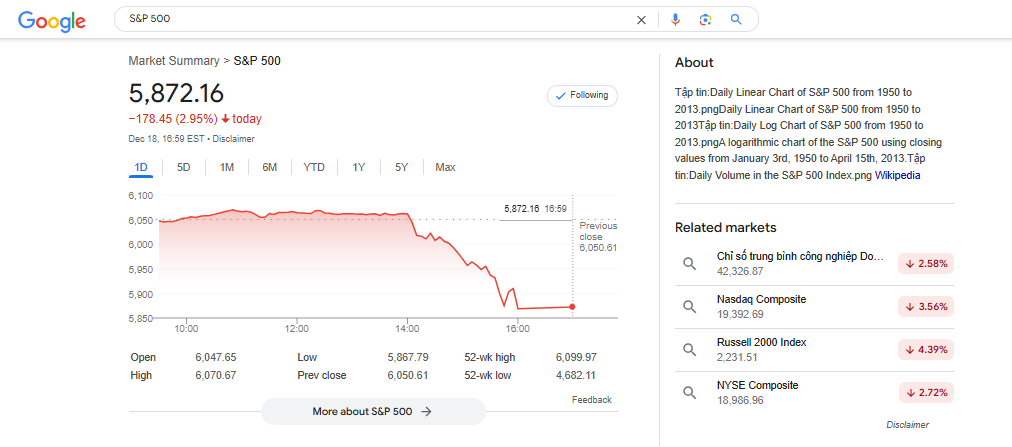

Moreover, the Fed’s decision significantly hit the stock market as well. The S&P 500 index declined noticeably. This underscores the close correlation between crypto and equities in reacting to changes in the Fed’s policies.

S&P 500 fell

Impact on the Near Future

The “Wait-and-See” Phase

The crypto market is in a “wait-and-see” mode. Investors will follow the next economic data closely, along with the actions of the Fed and other central banks.

Increased Volatility Likely

In the short run, the market is likely to be very volatile, particularly as it enters the Christmas period when there is usually low liquidity.

Long-Term Factors

However, it should be underlined that the crypto market demonstrated very strong growth throughout 2024, despite inflation and high-interest rates. Influential long-term growth drivers for cryptocurrencies may come from favorable regulatory changes, more institutional investments, or the formal approval of Bitcoin exchange-traded funds.

For instance, Bitcoin ETFs have seen huge inflows of money, even more than traditional gold ETFs. This means that institutions are finally starting to pay more attention to crypto.

Observations

This time around, the move by the Fed is an economic one but a “shock,” particularly to the crypto market, which had been riding high after immense growth in recent times. Tremendous disappointment and anxiety are natural when valuable assets drop in value within hours.

On the other hand, this serves as a reminder: the unexpected, along with risk, is inherent in crypto. Investors should keep a cool head, evaluate information with care, and avoid being swayed by short-term emotions. Don’t be overly pessimistic during “bloodbaths,” as they may present opportunities to buy quality assets at better prices.

Conclusion

The crypto market has its own rules and is very susceptible to macroeconomic influences. The Fed’s decision is among many, and understanding such developments is crucial for any crypto investor.

Remember, investing is a long-term game. Short-term ups and downs shouldn’t shake your resolve. Keep learning, keep researching, and make informed decisions.

[ad_2]

Source link