[ad_1]

Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, has created a perplexing scenario for investors recently. Despite a noticeable decline in its price, on-chain data reveals that large investors, often referred to as “whales,” are accumulating ETH. This could signal a potential buying opportunity, though technical indicators suggest a weakening uptrend, leaving Ethereum’s near-term future uncertain.

Related Reading: Solana Searching For Direction: Will SOL Break Free Or Fall Flat?

Ethereum Whales See Opportunity In Price Dip

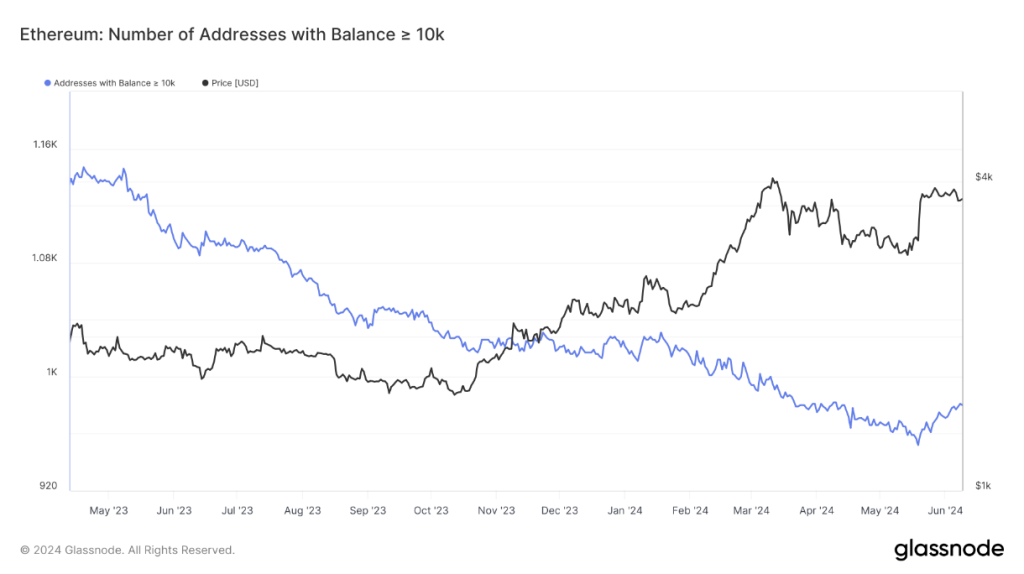

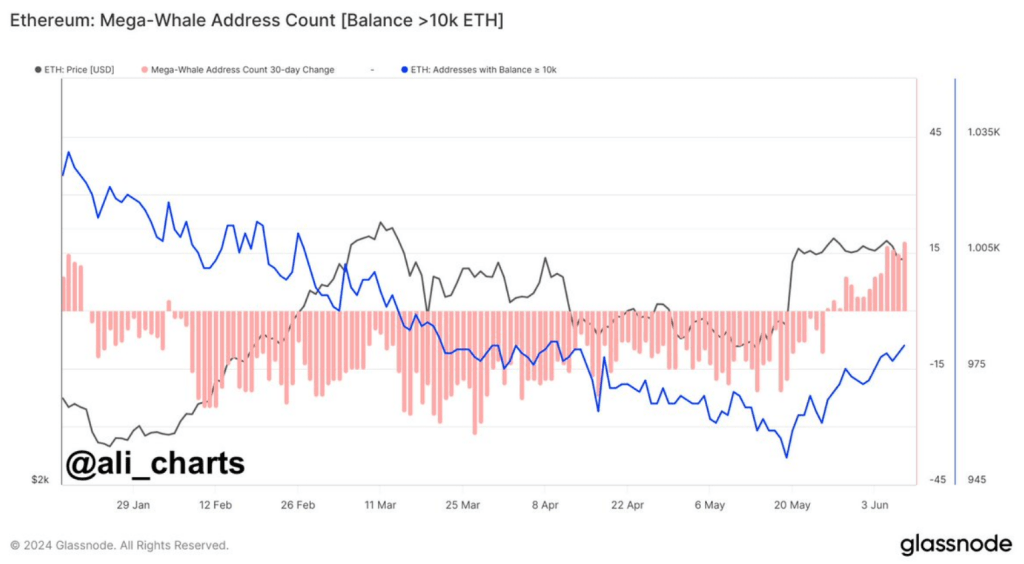

In recent analysis by NewsBTC, it was revealed that wallets holding over 10,000 ETH have been steadily acquiring more tokens since the end of May. This period of accumulation, based on Glassnode data, coincides with a drop in Ethereum’s price from around $3,074 to its current price of $3,670. The significant increase in holdings by these large investors suggests that they see the current price decline as an attractive entry point, anticipating a future price rise.

Adding to the bullish sentiment, CryptoQuant’s Netflow data for Ethereum has shown a dominance of negative flows in recent weeks. This means more ETH is leaving exchanges than entering them, a traditional indicator that investors are holding onto their ETH rather than selling it. This behavior can reduce the available supply on the market, potentially pushing prices up in the long run.

Related Reading: $2 Billion Crypto Funds Flow Into Market On Rate Cut Buzz

Technical Indicators Raise Red Flags

Despite the optimistic signs from whale accumulation and exchange outflows, technical indicators paint a less rosy picture. Ethereum has been trading in a narrow range around $3,600 for the past three days, showing a slight decline of approximately 0.8% today. While the Relative Strength Index (RSI) remains above 50, indicating a slight uptrend, it is currently on a downward trajectory. If this trend continues and the RSI falls below the neutral line, it could suggest a potential price dip.

The number of #Ethereum addresses holding 10,000+ $ETH has increased by 3% in the last three weeks, signaling an important spike in buying pressure! pic.twitter.com/7qq5HgGP37

— Ali (@ali_charts) June 9, 2024

The RSI’s downward movement indicates weakening momentum, which, if not reversed, might lead to further declines in Ethereum’s price. This bearish technical outlook contrasts sharply with the positive on-chain data, creating a complex situation for investors trying to predict the market’s next move.

Market Awaits A Significant Catalyst

The near-term future of Ethereum appears to hinge on the emergence of a significant catalyst. Broader market sentiment could play a crucial role, with a positive shift potentially reigniting the uptrend. Additionally, upcoming news or developments specific to the Ethereum network could also serve as a catalyst for price movement. Successful upgrades or increased adoption of decentralized applications (dApps) built on the Ethereum blockchain could trigger renewed investor interest and drive prices higher.

Featured image from Harbor Breeze Cruises, chart from TradingView

[ad_2]

Source link