[ad_1]

Data shows the Bitcoin funding rates on exchanges have turned negative, a sign that the shorts have now become the dominant force in the market.

Bitcoin Funding Rates Have Turned Negative After Market Crash

As pointed out by an analyst in a CryptoQuant Quicktake post, the Bitcoin funding rates have seen a sharp decline recently. The “funding rate” refers to a metric that keeps track of the periodic fee that derivatives contract holders are currently exchanging with each other.

When the value of this indicator is positive, it means the long investors are paying a premium to the short ones in order to hold onto their positions. Such a trend implies a bullish sentiment is shared by the majority in the sector.

On the other hand, the metric being negative implies a bearish mentality could be the dominant one in the market as the short holders outweigh the longs.

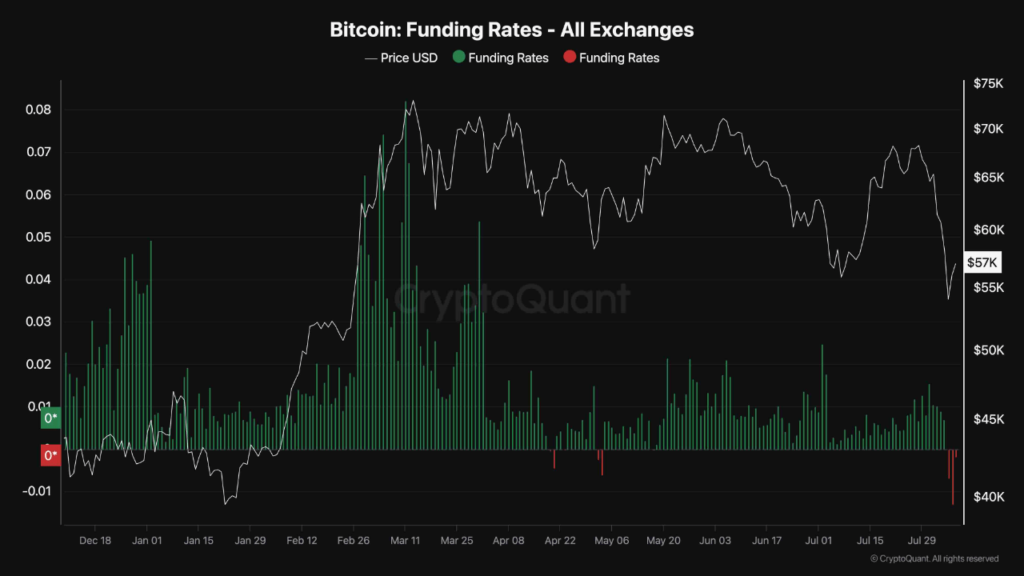

Now, here is a chart that shows the trend in this Bitcoin indicator for all exchanges over the past few months:

As displayed in the above graph, the Bitcoin funding rate had been positive throughout the year 2024, save for a couple of small dips into the negative region, until this latest crash, which finally took the indicator to notable red values.

The earlier positive values were naturally due to the fact that the market had a bullish atmosphere to it, so the average investor was trying to bet on the price to rise. From the graph, it’s visible that this positive sentiment was the strongest during the rally to the all-time high (ATH) price fueled by the spot exchange-traded fund (ETF) demand.

During the consolidation period that had followed this rally, BTC had seen a couple of notable drawdowns, but they weren’t enough to shake off the bullish mood. The recent sharp crash, though, appears to have finally caused investors to have a bearish outlook on the cryptocurrency.

The Bitcoin crash had resulted in a huge amount of long liquidations in the market, triggering what’s known as a squeeze. In a squeeze event, a sharp swing in the price causes mass liquidations, which in turn fuels the price move further. This then unleashes a cascade of more liquidations.

Since the latest such event involved the longs, it would be called a long squeeze. In general, an event of this kind is more likely to affect the side of the derivatives market that is more dominant. As this power balance has shifted towards the shorts now, it’s possible that the market could instead see a short squeeze in the near future.

Naturally, it’s not necessary that a short squeeze should take place, but if the price ends up witnessing some volatility, it’s possible it may end up punishing the short-heavy market.

BTC Price

Bitcoin has been steadily making recovery from the crash as its price has now climbed back to $57,500.

[ad_2]

Source link