[ad_1]

Bitcoin has experienced a calm weekend, maintaining its momentum above the $100,000 mark after breaking this milestone on Wednesday and setting new highs. The crypto market is buzzing with anticipation as BTC consolidates near its historic levels, with traders and investors eagerly awaiting its next move.

Adding to the excitement, CryptoQuant analyst Maartunn recently highlighted compelling data on CME Options Open Interest (USD) – Stacked by Position. This data points to growing activity among institutional traders, suggesting that a significant price movement could be on the horizon. Historically, similar spikes in open interest have preceded major volatility in Bitcoin’s price, making this metric one to watch closely.

While Bitcoin’s quiet weekend offers a moment of respite for market participants, the underlying signals suggest that this calm may not last long. As the crypto king hovers near its all-time highs, many are speculating whether it will continue its upward trajectory or face a temporary pullback.

Either way, the stage is set for an intriguing week ahead, with key market metrics hinting at heightened activity and potential fireworks in the coming days. Stay tuned as Bitcoin’s next move could define the narrative for the broader cryptocurrency market.

Bitcoin Open Interest: Calls Stacking Up

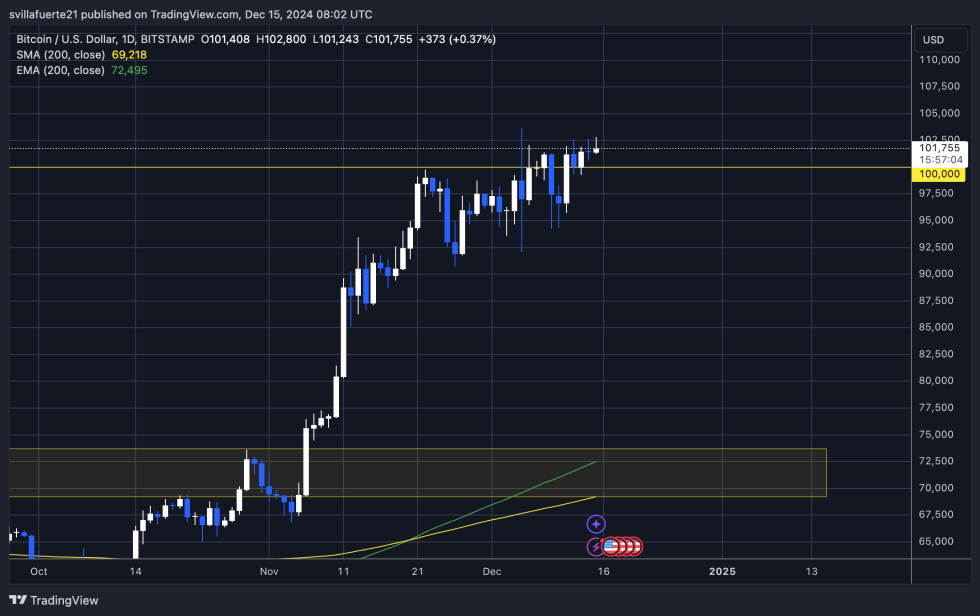

Bitcoin has been in an uptrending range since late November, consistently making higher highs but failing to set a massive breakout. The price action has remained steady, with Bitcoin continuing to climb toward new levels. Despite the positive momentum, the market is waiting for a decisive move to push the price higher, and many traders are closely monitoring Bitcoin’s ability to break above its all-time highs (ATH).

CryptoQuant analyst Maartunn recently shared key insights on X, highlighting an interesting development in Bitcoin’s market structure. According to Maartunn, BTC stacked put positions have reached multi-year highs, which could signal a brewing storm.

In his analysis, he presents a chart showing the rising activity in put options, often reflecting a build-up of high-leverage positions. This type of market behavior tends to precede massive price movements, especially when leveraged positions are liquidated.

While Bitcoin continues its upward push, the market is walking a fine line. If Bitcoin fails to break above its ATH and continues to trade within the current range, there is a significant risk of a retrace. A correction could follow, especially if high-leverage positions start to unwind. With the growing open interest in put options, this adds to the uncertainty.

BTC Testing Liquidity In Price Discovery

Bitcoin is trading at $101,750 after days of being stuck below the $102,000 mark. While the price has remained resilient, it has struggled to break through key resistance levels. For the bulls to maintain their momentum, the price needs to decisively break above $103,600. A strong push past this level would signal a continuation of the uptrend and potentially lead to new highs.

However, if BTC fails to break above $103,600, there is a strong likelihood that it will retest lower demand levels. The next significant support zone to watch is around $95,500. A failure to clear $103,600 would indicate that the bears are starting to gain control, and BTC could face a deeper correction as traders begin to sell into weakness.

In the coming days, traders will be closely watching for any signs of a breakout or breakdown. A decisive move above $103,600 could trigger a rally, but if BTC falters and falls back toward $95,500, the market could experience increased volatility, and further downside may follow.

Featured image from Dall-E, chart from TradingView

[ad_2]

Source link