[ad_1]

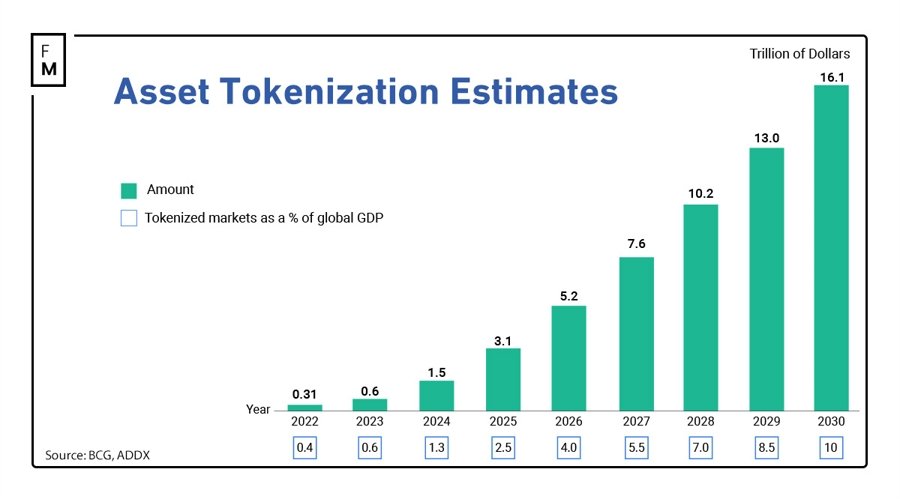

On the surface, institutional adoption of digital assets is

thriving. The fact that multiple major firms like HSBC and BlackRock are

beginning to offer tokenized products is a testament. One recent projection

even suggested that by 2030 the tokenized asset market could go as high as $16.1

trillion.

Institutional participation has long been viewed as a

necessary step for a larger mainstream adoption of digital assets, so the

market is excited to welcome these new products. While this all sounds

overwhelmingly positive, there is unfortunately still a significant hurdle that

will need to be addressed before we see any broader acceptance and usage of digital assets:

siloed liquidity.

Now, there are many different blockchain networks that, in

most cases, don’t easily share resources. This ranges across public networks,

private networks and sidechains, all of which struggle to move assets between

them.

For example, JP Morgan has their

own private blockchain, named Onyx. While JP Morgan is a massive, global firm

and can certainly offer its customers services on this chain, it is still

effectively walled off from larger public networks like Ethereum, as well as

other institutional ones.

Compare this situation to the adoption of the internet

around thirty years ago. It didn’t really take off until we had one “World Wide

Web” that allowed access to all services via a single portal with no need to

understand internet

protocols. The whole of Web3 needs to work in just the same way to become

functional for business.

Real World Asset Tokenization is poised to revolutionize asset financing by bringing liquidity into even the most illiquid markets and opening the doors for new retail investors to participate.

Experts predict a $16 trillion market for tokenized assets by 2030. pic.twitter.com/aFsCqM1qhB

— Pepesso (@0xPepesso) April 7, 2024

Challenges and Considerations in Web3 Asset Transfers

In an attempt to address such issues, firms like Deutsche Bank

have begun experimenting with ways to connect different institutional networks,

and they are doing so via the creation of “bridges.”

Bridges aren’t entirely new to Web3, and they act as

third parties that can transfer assets between different networks. However,

there are some catches. Generally, bridging is a relatively expensive process

to perform, usually incurring fees on both chains.

Furthermore, bridges are controlled by centralized

operators, making these single points of failure among the most attack-prone

elements of the modern Web3 landscape. While we have yet to see what Deutsche

Bank will ultimately create, bridging is not usually a solution that financial

institutions, or retail users for that matter, will find attractive.

Fortunately, bridging isn’t the only option that is available.

Financial markets are shifting towards asset tokenization, revolutionizing asset management and investment.#Chainlink emphasizes interoperability and data integration, echoing #TokenFi‘s vision of a future where tokenized assets reshape finance.

📰👇https://t.co/87Qp3ufa3X pic.twitter.com/BGSfD8E2ss

— TokenFi (@tokenfi) April 26, 2024

A Universal Solution

Instead of a series of siloes, what is needed is a

universal, interoperable layer that can connect liquidity across all of these

networks, all without bridges that demand multiple hops and the related fees.

Fortunately, this technology

now exists, decades earlier than anyone thought possible.

Zero knowledge (ZK) technology allows for near-instant,

cross-network transfers that are completely secure and cost almost nothing in

transaction fees. This is possible because these protocols are able to

generate a cryptographic “proof” that can confirm the veracity of any data,

while never needing to reveal what that data is.

ZK proofs can allow for moving assets securely across

networks without the need for any overly complex third-party protocols. The

cryptography that powers these proofs means that instead of “bridging” assets,

a single proof can be sent that ineffably confirms the veracity of any given

transaction, all while using only a fraction of network resources.

Early Crypto Adopter Says Advantages of Zero-Knowledge Technology Outweigh Perceived Development Complexity #zeroknowledge – @prom_io https://t.co/RxlkUFmO7Z

— Bitcoin.com News (@BTCTN) May 22, 2024

Implementing a ZK powered interoperability layer will be the

“aggregated” approach, and will be key to creating a Web3 space that feels like

one single chain. Just like how the modern internet feels like a single

service, all of the myriad of protocols and providers in the background simply

merge into one experience for the end user.

This is what will bring a new wave of institutions and their

products into this revolution by bringing down the barriers that are currently

holding back broader institutional adoption.

By making the network that a given asset is built upon

trivial, all liquidity would become unlocked across the entire Web3 ecosystem.

This would be a much more attractive situation for institutions to launch new

products into, and it would also draw in additional retail interest, further

expanding the entire market. Web3 could finally realize the vision of an

equitable, digital future, by being able to provide real financial tools that

have no barriers or obstacles.

On the surface, institutional adoption of digital assets is

thriving. The fact that multiple major firms like HSBC and BlackRock are

beginning to offer tokenized products is a testament. One recent projection

even suggested that by 2030 the tokenized asset market could go as high as $16.1

trillion.

Institutional participation has long been viewed as a

necessary step for a larger mainstream adoption of digital assets, so the

market is excited to welcome these new products. While this all sounds

overwhelmingly positive, there is unfortunately still a significant hurdle that

will need to be addressed before we see any broader acceptance and usage of digital assets:

siloed liquidity.

Now, there are many different blockchain networks that, in

most cases, don’t easily share resources. This ranges across public networks,

private networks and sidechains, all of which struggle to move assets between

them.

For example, JP Morgan has their

own private blockchain, named Onyx. While JP Morgan is a massive, global firm

and can certainly offer its customers services on this chain, it is still

effectively walled off from larger public networks like Ethereum, as well as

other institutional ones.

Compare this situation to the adoption of the internet

around thirty years ago. It didn’t really take off until we had one “World Wide

Web” that allowed access to all services via a single portal with no need to

understand internet

protocols. The whole of Web3 needs to work in just the same way to become

functional for business.

Real World Asset Tokenization is poised to revolutionize asset financing by bringing liquidity into even the most illiquid markets and opening the doors for new retail investors to participate.

Experts predict a $16 trillion market for tokenized assets by 2030. pic.twitter.com/aFsCqM1qhB

— Pepesso (@0xPepesso) April 7, 2024

Challenges and Considerations in Web3 Asset Transfers

In an attempt to address such issues, firms like Deutsche Bank

have begun experimenting with ways to connect different institutional networks,

and they are doing so via the creation of “bridges.”

Bridges aren’t entirely new to Web3, and they act as

third parties that can transfer assets between different networks. However,

there are some catches. Generally, bridging is a relatively expensive process

to perform, usually incurring fees on both chains.

Furthermore, bridges are controlled by centralized

operators, making these single points of failure among the most attack-prone

elements of the modern Web3 landscape. While we have yet to see what Deutsche

Bank will ultimately create, bridging is not usually a solution that financial

institutions, or retail users for that matter, will find attractive.

Fortunately, bridging isn’t the only option that is available.

Financial markets are shifting towards asset tokenization, revolutionizing asset management and investment.#Chainlink emphasizes interoperability and data integration, echoing #TokenFi‘s vision of a future where tokenized assets reshape finance.

📰👇https://t.co/87Qp3ufa3X pic.twitter.com/BGSfD8E2ss

— TokenFi (@tokenfi) April 26, 2024

A Universal Solution

Instead of a series of siloes, what is needed is a

universal, interoperable layer that can connect liquidity across all of these

networks, all without bridges that demand multiple hops and the related fees.

Fortunately, this technology

now exists, decades earlier than anyone thought possible.

Zero knowledge (ZK) technology allows for near-instant,

cross-network transfers that are completely secure and cost almost nothing in

transaction fees. This is possible because these protocols are able to

generate a cryptographic “proof” that can confirm the veracity of any data,

while never needing to reveal what that data is.

ZK proofs can allow for moving assets securely across

networks without the need for any overly complex third-party protocols. The

cryptography that powers these proofs means that instead of “bridging” assets,

a single proof can be sent that ineffably confirms the veracity of any given

transaction, all while using only a fraction of network resources.

Early Crypto Adopter Says Advantages of Zero-Knowledge Technology Outweigh Perceived Development Complexity #zeroknowledge – @prom_io https://t.co/RxlkUFmO7Z

— Bitcoin.com News (@BTCTN) May 22, 2024

Implementing a ZK powered interoperability layer will be the

“aggregated” approach, and will be key to creating a Web3 space that feels like

one single chain. Just like how the modern internet feels like a single

service, all of the myriad of protocols and providers in the background simply

merge into one experience for the end user.

This is what will bring a new wave of institutions and their

products into this revolution by bringing down the barriers that are currently

holding back broader institutional adoption.

By making the network that a given asset is built upon

trivial, all liquidity would become unlocked across the entire Web3 ecosystem.

This would be a much more attractive situation for institutions to launch new

products into, and it would also draw in additional retail interest, further

expanding the entire market. Web3 could finally realize the vision of an

equitable, digital future, by being able to provide real financial tools that

have no barriers or obstacles.

[ad_2]

Source link