[ad_1]

A quant has explained how the latest trend in the Bitcoin Coinbase Premium Index could imply a buying opportunity for the asset.

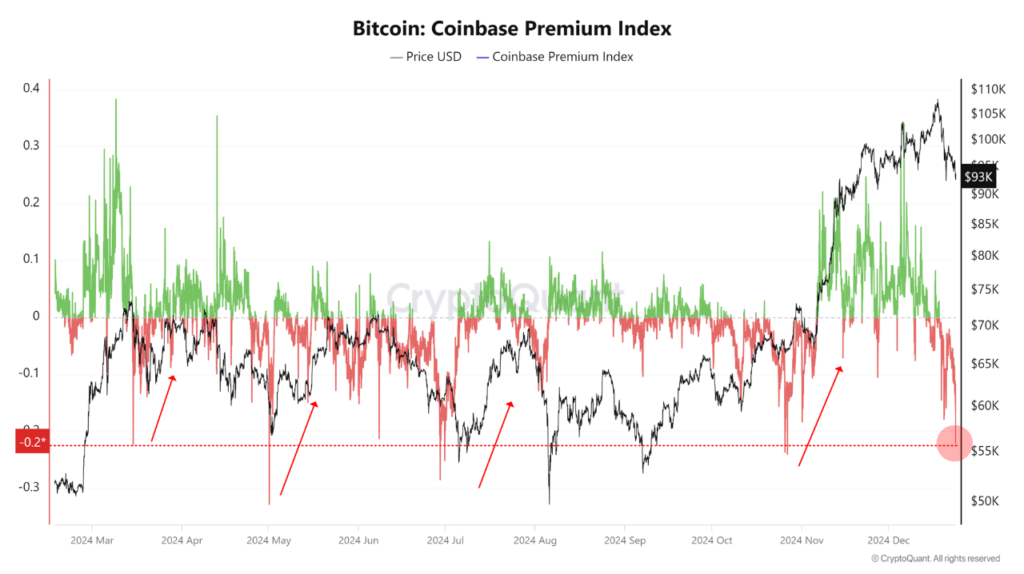

Bitcoin Coinbase Premium Index Has Plunged To -0.221%

In a CryptoQuant Quicktake post, an analyst talked about the latest development in the Bitcoin Coinbase Premium Index. The “Coinbase Premium Index” refers to a metric that keeps track of the percentage difference between the BTC price on Coinbase (USD pair) and that on Binance (USDT pair).

When the value of this metric is positive, it means the cryptocurrency is trading at a higher rate on Coinbase than on Binance. Such a trend implies there is a higher buying pressure or a lower selling pressure present on the former as compared to the latter.

On the other hand, the indicator being under the zero mark suggests that Binance users are participating in a higher amount of buying than Coinbase ones as they have pushed BTC to a higher value there.

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Index over the last few months:

From the graph, it’s visible that the Bitcoin Coinbase Premium Index has seen a sharp decline into the negative region recently, meaning that sellers have appeared on Coinbase.

Alongside this selling, the BTC price has also witnessed a decline, which would suggest the negative premium could be the source of it. The cryptocurrency has actually been following the indicator in this manner throughout the year, with its price going up and down alongside buying and selling shifts on Coinbase.

The reason behind this relationship potentially lies in the fact that Coinbase is home to US-based institutional investors, who have had a significant presence in the market this year.

The Coinbase Premium Index being red right now would naturally imply these giant investors are selling. Considering that BTC’s price has been following the metric, this would be a bearish signal for the asset.

There exists another pattern, however, that could imply a different outcome for Bitcoin. As the quant has highlighted in the chart, the metric has seen a rebound whenever its value has gone to the -0.2% mark during the past year.

The explanation behind the pattern may be that it’s usually around this level of selling that new buyers show up and decide to accumulate on the dip, pushing the metric as well as the price up in the process.

The current value of the indicator is sitting at -0.221%, so it’s possible that Bitcoin could be close to reaching a bottom, if it hasn’t already formed one. This would only be, of course, if the institutional investors think that the bull run is still on.

BTC Price

Bitcoin briefly went under the $93,000 level yesterday, but it seems the coin has found a rebound as its price is now trading around $94,100.

[ad_2]

Source link