[ad_1]

Ondo Finance (ONDO) has emerged as a standout project in the crypto market, gaining significant attention for its focus on real-world asset (RWA) tokenization. Specializing in bringing US Treasury Bonds onto the blockchain, ONDO is positioning itself as a leader in bridging traditional finance and decentralized finance. This innovative approach has fueled tremendous growth for ONDO, the project’s native token, which has surged over 235% since November 5.

Related Reading

The momentum hasn’t slowed as ONDO continues breaking all-time highs, with a remarkable rally since early December captivating investors and analysts alike. Despite this bullish trend, the market is eyeing potential volatility ahead. Recent data from Santiment highlights an increase in ONDO exchange inflows, often an early indicator of significant price movements.

As Ondo Finance captures market interest, its focus on tokenizing US Treasury Bonds aligns with the growing narrative of connecting traditional finance with blockchain technology. This convergence of utility and innovation makes Ondo a compelling project in this market cycle. While the price action remains strong, the rising exchange inflows suggest that ONDO could be gearing up for a pivotal phase. Investors are now closely monitoring the token for signs of its next big move.

ONDO Testing Price Discovery

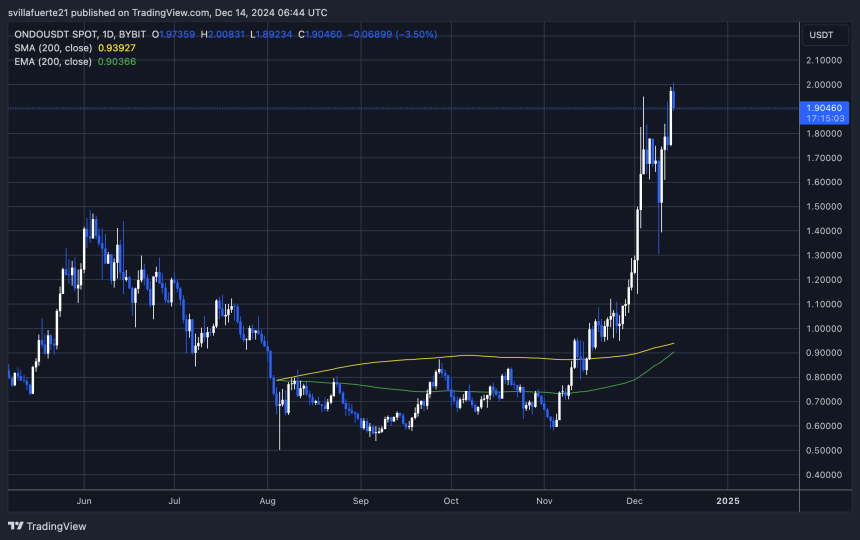

Ondo Finance’s native token, ONDO, has been in a strong upward trend, testing price discovery since early December after breaking its previous all-time high (ATH) at $1.48. This rally has propelled ONDO to new heights, with the token recently peaking at $2 just a few hours ago. The consistent upward momentum highlights growing investor interest, but the current price levels signal that volatility could soon make a return.

Top crypto analyst Ali Martinez recently shared revealing data on X; Martinez pointed out that ONDO’s exchange inflows have been steadily increasing. Historically, spikes in exchange inflows for ONDO have been correlated with sharp price movements, both upward and downward. These metrics serve as a critical warning to traders and investors about the potential for significant volatility ahead.

Martinez emphasized the importance of monitoring these inflows closely. According to his analysis, a spike in inflows typically reflects heightened activity, with holders potentially preparing to sell or new buyers entering the market in anticipation of further gains. “Watch out for the next move,” Martinez cautioned, indicating that ONDO’s price could either correct sharply or extend its rally further into uncharted territory.

Related Reading

As ONDO continues to test price discovery, the next few days will likely be pivotal. If the token sustains its momentum above key support levels, it could push higher, solidifying its position as a top-performing asset in this market cycle. However, traders must remain vigilant, as increased exchange inflows suggest that dramatic price swings are imminent.

Technical Analysis: Levels To Watch

ONDO is currently trading at $1.90 after a failed attempt to break above the $2 mark earlier today. The price briefly touched this key psychological level before retracing, signaling a potential resistance zone. Despite this setback, ONDO remains one of the market’s standout performers, showcasing impressive strength as it continues to outperform most other assets.

This recent pullback could be a setup for a larger move upward, as the price has consistently demonstrated bullish momentum over the past weeks. If the token manages to hold above the critical $1.83 support level, it could pave the way for another rally, potentially breaking past the $2 mark and entering a new phase of price discovery. However, traders should be cautious as volatility appears to be on the rise, with increased exchange inflows indicating heightened market activity.

Related Reading

As the price hovers near its recent highs, the coming days will likely determine its short-term trajectory. Holding the $1.83 level will be crucial for bulls aiming to sustain the uptrend. Conversely, losing this support could lead to further corrections. With the token’s strong performance and market interest, Ondo Finance remains a key asset to watch in this evolving market cycle.

Featured image from DALL-E, chart from TradingView

[ad_2]

Source link