[ad_1]

As Ethereum broke past $4,000 on December 7th, one notable crypto personality placed a sell order valued at $119.7 million.

According to on-chain data, Tron’s Justin Sun completed a transfer of 29,920 ETH to HTX as Ethereum continued its impressive run three days ago.

Ethereum’s price last touched the $4k mark last March, and the current price action comes at a time of growing ETF demand for Ethereum. CoinGlass data shows Ether ETFs enjoyed their largest daily inflow of roughly $428 million on December 5th.

Justin’s decision to dump over $119 million worth of ETH has raised questions and healthy debates on the Tron founder’s current strategy. Is he cashing out or just recalibrating a plan to generate more profit?

After briefly flirting with the $4k level, ETH immediately corrected it, and it’s now trading in the $3,700 to $3,800 levels as of this writing.

Justin Sun Locking In The Profits?

Justin Sun bought 392,474 ETH valued at $1.19 billion, with an average market price of $3,027 from February to August. The Tron founder is locking in the profits based on Justin’s recent market decision.

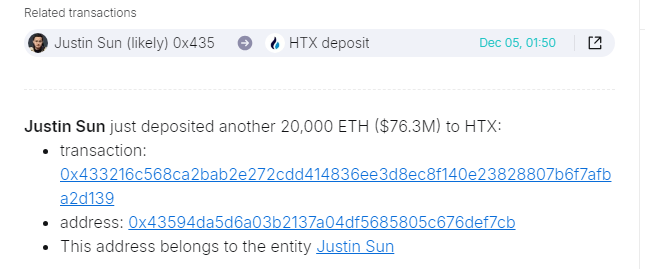

The crypto entrepreneur also added 20,000 ETH to HTX last December 5th. This transaction, valued at $76.3 million, was the second-largest crypto move past $3,800.

Then, on December 8th, Sun added 29,920 Ether, worth $119.7 million, to HTX after the asset’s price broke $4k. According to Spot On Chain, Sun’s transaction earned him a profit of $366 million, excluding the income from airdrops and staking.

Sun Continues To Buy And Move ETH Tokens

Since early November, Sun has moved 41,630 ETH, valued at $145.9 million, to a few centralized agencies. From this batch, 39,000 tokens were transferred to HTX and 2,630 tokens to Poloniex at an average market price of $3,505.

Interestingly, the Tron founder also added staking rewards to HTX, including 322,119 EIGEN coins with a market value of $1.44 million and another 175,021 ETHFI tokens amounting to $516,000.

Ether Shows Solid Growth

Ethereum’s recent price surge, which allowed it to hit $4k, started briefly last November. For a long time, Ethereum has considered this price level to be its resistance zone. On-chain data and charts suggest that this price level boasts substantial selling pressure, so Ether’s failure to hold the price this week is understandable.

Although the market has rejected the price, many analysts suggest that the bulls among buyers will likely make another run to breach the resistance level. With this latest rejection, the market is advised to watch out for sideways price movements. Still, Ethereum has a favorable market structure, and if it breaches the channel’s lower trendline, it’s possible to revisit the $3.5k level.

Justin Sun’s $119 million Ethereum sell-off has sparked debate over whether it signals profit-taking or caution amidst Ethereum’s $4,000 rally. While Sun secured significant gains, his continued staking and transfers suggest a complex strategy rather than a simple exit. As Ethereum maintains strong fundamentals, investors will watch closely to see if this sell-off is a trend or an isolated move.

Featured image from Screen Rant, chart from TradingView

[ad_2]

Source link