[ad_1]

The recent increase in the appeal of spot Bitcoin exchange-traded funds (ETFs) in the United States has temporarily ceased.

Related Reading

On Tuesday, these funds underwent a reversal, resulting in net outflows of $79.01 million, following an extraordinary seven-day streak of positive inflows. Farside Investors are the source of this data, a company that specializes in the analysis of ETF flows.

A Brief Obstacle

The $79 million outflow represents a significant shift in sentiment among investors who had previously demonstrated a strong interest in Bitcoin ETFs. Over the span of two days last week, the market attracted around $1 billion in inflows, implying a robust demand for these financial products.

The main cause of this negative change was Ark and 21Shared’s ARKB, which resulted in a substantial $134.7 million outflow.

BlackRock’s IBIT, the best-performing bitcoin ETF by net assets, drew $43 million. Fidelity’s FBTC and VanEck’s HODL, which received $8.8 million and $3.8 million, respectively, also helped. There were no new flows on the remaining eight funds, including Grayscаle’s GBTC, during the day.

Nevertheless, Bitcoin ETFs could bring in more than $21 billion to date. This number clearly signifies the rising use of Bitcoin as a new asset class and it is only going to see more hedge funds take larger positions.

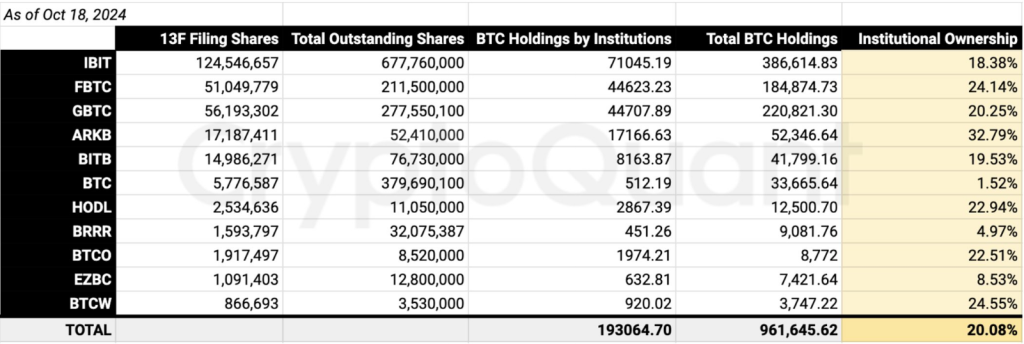

US-traded spot Bitcoin ETFs have also seen significant interest from institutional investors, with 20% of the market owned by them as of October 22.

Institutional ownership of U.S. #Bitcoin Spot ETFs is around 20%, with asset managers holding 193K BTC (per Form 13F filings). pic.twitter.com/9YTOEH3G5w

— Ki Young Ju (@ki_young_ju) October 22, 2024

Institutional Demand Is Still Strong

Regardless, while the latest ETF flow swings have been significant in themselves, they can not distract from what is an ongoing push towards institutional Bitcoin adoption. Among the main companies who have made large investments in these funds are Goldman Sachs and Millennium Management.

The SEC’s approval of options trading on 11 Bitcoin ETFs will help investors manage their Bitcoin exposure, boosting interest.

Through more efficient position hedging made possible by options trading, investors can help to steady the market and lower volatility over time. Analysts argue that this would draw more institutional money to the industry, therefore supporting Bitcoin’s reputation as a credible investment tool.

Bitcoin ETF: Looking Ahead

Although outflows may cause concern, many analysts are positive about Bitcoin ETFs. Options trading’s SEC approval is a turning point that could improve market efficiency and liquidity.

More institutional players coming into the space are likely to change the dynamics. The current pause in inflows could be a temporary phenomenon only; investors are repositioning their strategies given the shift in market conditions.

Related Reading

The outlook for spot Bitcoin ETFs, looking into the long term, appears quite positive with the current uptick in adoption from the institutional space and trading of Bitcoin at or near three-month highs.

The recent outflows from spot Bitcoin ETFs may indicate a temporary setback; however, the prevailing trend of heightened institutional interest and regulatory support indicates that this asset class is here to stay. Investors will be intently monitoring the rapid evolution of this market for any new developments.

Featured image from The Rio Times, chart from TradingView

[ad_2]

Source link