[ad_1]

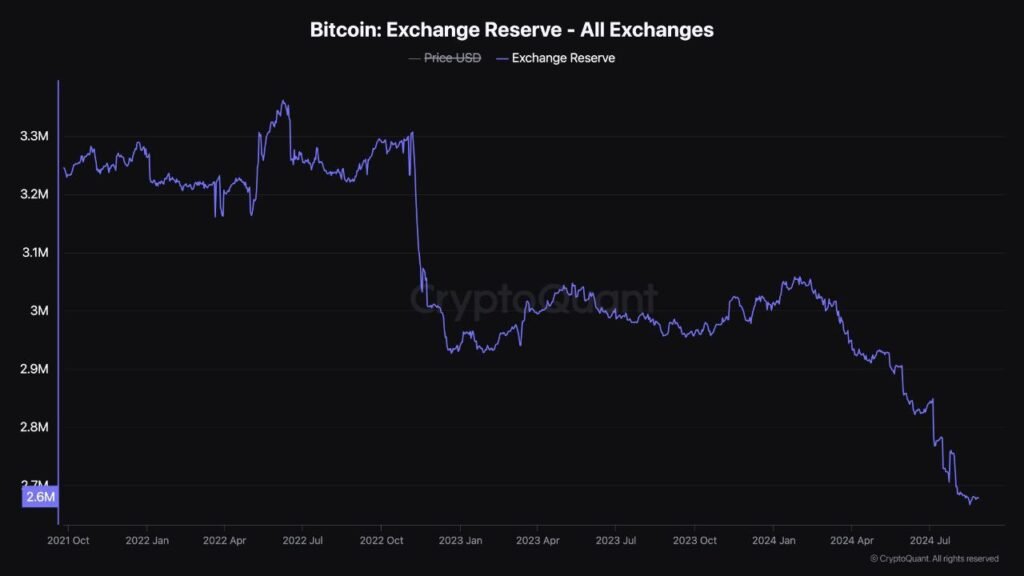

Bitcoin, the largest crypto asset appears to be experiencing heightened optimism among investors as evidenced by the consistent decline in the digital asset’s balances on several cryptocurrency exchanges. Particularly, the drop in BTC exchange reserves denotes that investors might be less inclined to sell their holdings in the short term, which is frequent with positive market sentiment and prospects for higher growth in the crypto landscape.

Investors Offloading Bitcoin From Crypto Exchanges

Following Bitcoin’s recent upward movement, Kyle Doops, a market expert and Crypto Banter Show host, has spotted a positive shift in sentiment among BTC investors. The market expert shared this optimistic development with the crypto community on the X (formerly Twitter) platform.

According to the expert, Bitcoin is currently leaving crypto exchanges, hinting at a reduction in selling pressure as BTC holders increasingly move their holdings off exchanges. He highlighted that this shift suggests that investors’ confidence is rising and indicates a bullish outlook for price stability in the long term.

The post read:

Bitcoin is leaving exchanges, hinting at less selling pressure as holders move their BTC off platforms. This shift signals growing investor confidence and could point to a bullish outlook for long-term price stability.

The development coincides with growing optimism about the crypto asset’s potential for price spikes in the future, which many already see as an indication that BTC may be gearing up for a bullish rally, solidifying its position as the flagship digital currency.

Kyle Doops, in a different post also pointed out a drop in another Bitcoin metric, especially the BTC Exchange Stablecoins Ratio that reflects a change in market dynamics. Specifically, the drop implies that investors are looking forward to acquiring BTC by converting stablecoins into the digital asset in the hope that prices will grow in the short and long term.

He underlined that the decline in the exchange stablecoins ratio for BTC suggests that there is strong purchasing power and that prices may surge in the future. Furthermore, the expert claims that such circumstances in the past have signaled a major increase in the value of Bitcoin, offering a bullish sign as investors and traders reposition themselves.

Is The BTC’s Recent Uptrend Over?

Despite the stark interest around BTC, the crypto asset encountered a setback earlier today, which saw its price falling from nearly $66,000 to the $64,500 level.

Presently, Bitcoin is trading at $64,517, indicating an almost 2% decline in the past day. Although BTC is currently demonstrating a negative sentiment, in the broader outlook like the 1-week and 1-month time frame, the digital asset has increased by 1.62% and 9.04% respectively.

BTC Investors might view the recent decline as a potential buy point as its trading volume has risen by over 45% in the past day. Nevertheless, its market cap is still down by about 1.57% in the last 24 hours.

Featured image from Unsplash, chart from Tradingview.com

[ad_2]

Source link