[ad_1]

Ethereum, the second largest crypto by market cap, is trading at $2,420 after a recent price rally. Ethereum has been up by 3.4% and 6.3% in the past 24 hours and seven days, respectively, which has raised hopes for an extended bullish run. As the price performance continues to unfold, some major developments are taking root, which could pave the way for Ethereum’s price to rally back above the $4,000 mark.

Stablecoin Transaction Volume Hits New High

Despite the bearish sentiment which has lingered in a 30-day timeframe, on-chain data shows that the Ethereum blockchain continues to witness massive activity, especially in the stablecoin niche. The stablecoin trading volume on the blockchain soared massively in August to break its previous all-time high. Particularly, the stablecoin trading volume reached $1.46 trillion.

This surge in stablecoin activity further solidifies Ethereum’s position as the go-to blockchain platform in the world of DeFi. As stablecoin adoption continues to rise, this could drive up Ethereum revenue due to demand for ETH tokens used to pay transaction fees. This increased utility could, in turn, contribute to its price reaching $4,000 or beyond.

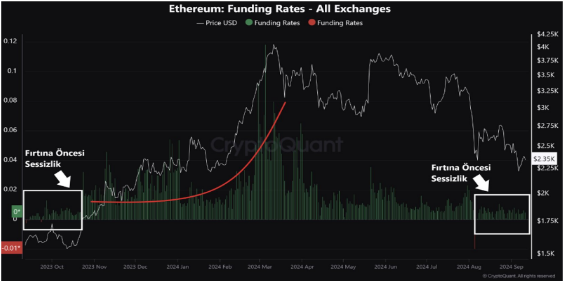

Watch Out For The 0.015 Point In Funding Rates

Another key factor to watch now for Ethereum is the funding rate. The funding rate is a metric that tracks the cost of holding a long or short position in the perpetual futures market. Funding rates reflect market sentiment, as positive funding rates indicate that longs are paying short positions, suggesting a bullish outlook, while negative rates show a bearish trend.

According to on-chain data from CryptoQuant, the Ethereum funding rate is approaching the 0.015 point. As an analyst at CryptoQuant pointed out, the Ethereum funding rate is currently hovering between 0.002 and 0.005. This movement is reminiscent of a pattern in September 2023, when the funding rate was similarly low.

Although these figures might appear modest for a typical bull market, a CryptoQuant analyst has noted that this could be the calm before a major upward movement. This is because the funding rates eventually crossed 0.015 in 2023, allowing Ethereum to “surge from the $1,500s to $4,000s.” A similar occurrence could see Ethereum surging massively to $4,000 in the next few months.

Ethereum: Network Growth

According to Santiment, the Ethereum network has witnessed massive growth in the past week, recently reaching a four-month high. Apart from its L2 solutions like Optimism and Arbitrum, the platform remains the foundation for decentralized finance (DeFi) and non-fungible tokens (NFTs). This network growth was accompanied by an increase in the creation of wallet addresses and active addresses.

At the time of writing, Ethereum is trading at $2,421. If these factors above align in favor of Ethereum, we could see ETH continue to approach the $4,000 mark.

Featured image from StormGain, chart from TradingView

[ad_2]

Source link